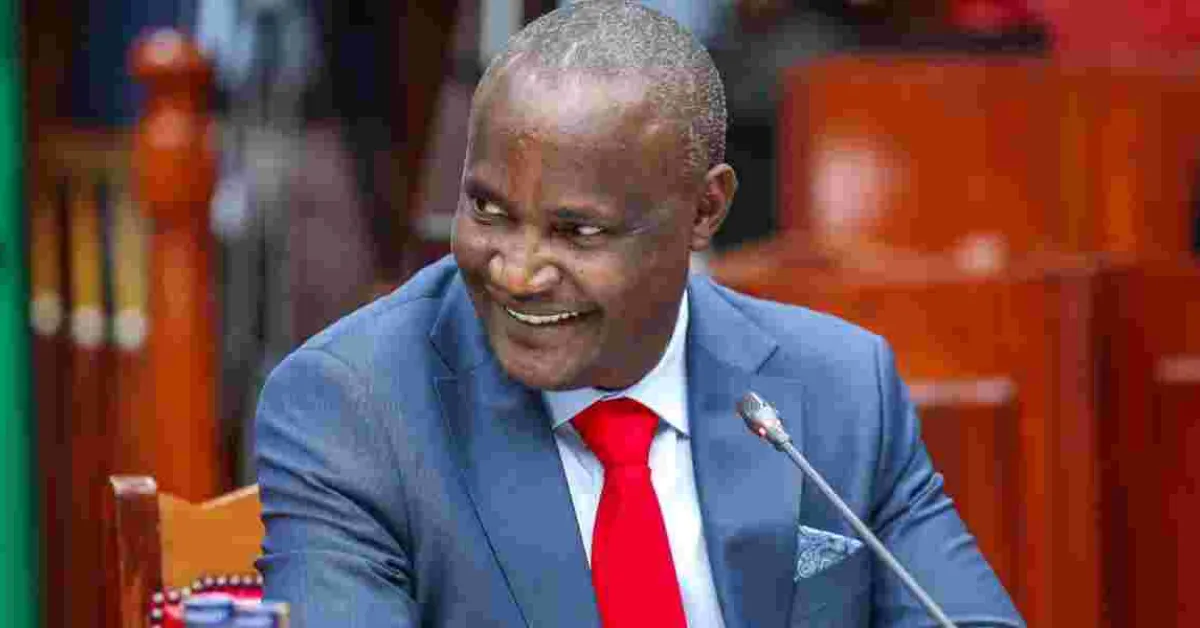

Treasury CS John Mbadi Unveils 3-Year Tax Cut Plan to Boost Economy

Treasury Cabinet Secretary John Mbadi has unveiled an ambitious plan to reduce taxes over the next three years, aiming to alleviate the financial burden on Kenyan citizens.

The plan, which includes lowering the Value Added Tax (VAT) from 16% to 14% and reducing corporate tax from 30% to 25%, was revealed during the launch of the Financial Year 2025/26 Budget Preparation Process at the Kenyatta International Convention Centre (KICC) on Monday. Mbadi emphasizes that these tax cuts are part of a broader strategy to foster economic resilience, particularly in vital sectors such as agriculture, manufacturing, and housing. Mbadi stated that no additional expenditures would be supported in the medium term. Instead, the focus will be on enhancing efficiency, accountability, and prudent resource management.

Despite fiscal constraints, the Cabinet Secretary assures stakeholders that the government would prioritize growth, expand opportunities, and focus on sectors critical for economic recovery. Agriculture, in particular, is set to remain at the forefront of the government's strategy to drive manufacturing and overall economic growth. Special attention will also be given to supporting small and medium enterprises (SMEs) and affordable housing projects. The Fourth Medium Term Plan, as outlined by Mbadi, includes initiatives aimed at transforming the MSME economy, healthcare, housing and settlement, and the development of the digital superhighway. These sectors are poised to receive dedicated attention, with the government striving to create a favourable environment for their growth and development.

Reflecting on the current fiscal year, Mbadi notes that despite challenges posed by the withdrawal of the 2024 Finance Bill, the implementation of the FY 2024/25 budget is progressing satisfactorily. The government has taken steps to realign priorities with available resources in light of the foregone additional revenue measures. The medium-term tax cuts are expected to have a positive impact on both households and businesses. By boosting purchasing power and enhancing business profitability, these measures aim to stimulate economic activity, increase consumer spending, and attract more investments into the country. This tax reduction plan represents a shift in the government's economic strategy. Previously, President William Ruto had defended plans to levy additional taxes as part of a strategy to enhance revenue and reduce reliance on borrowing.

However, the current approach reflects a more balanced stance towards economic management, focusing on both revenue generation and financial relief for citizens. To ensure successful implementation of the tax reduction plan, the government will adopt a new financial management system with an emphasis on transparency in procurement processes. Treasury Principal Secretary Chris Kiptoo stresses the importance of adhering to the Budget Review and Outlook Paper (BROP), sector budgets, and revenue bills, including a review of county allocations.

Add new comment