Kenyan Business Leaders and Politicians Face Auction Over Unpaid Debts

In Kenya’s dynamic business arena, a confluence of economic challenges has led numerous prominent entrepreneurs and political figures to confront escalating financial pressures, as creditors resort to aggressive asset seizures to recover unpaid debts.

Key sectors, including manufacturing, agribusiness, real estate, construction, cargo handling, tea export, and food processing, are experiencing significant strain as loan defaults trigger auction threats from financial institutions. A growing number of high-profile business magnates, such as Equity Bank founder Peter Munga, tea exporter David Langat of DL Group, and Josiah Njoroge Njuguna of Nyoro Construction Company, have become embroiled in legal disputes with financial institutions seeking to recover outstanding dues.

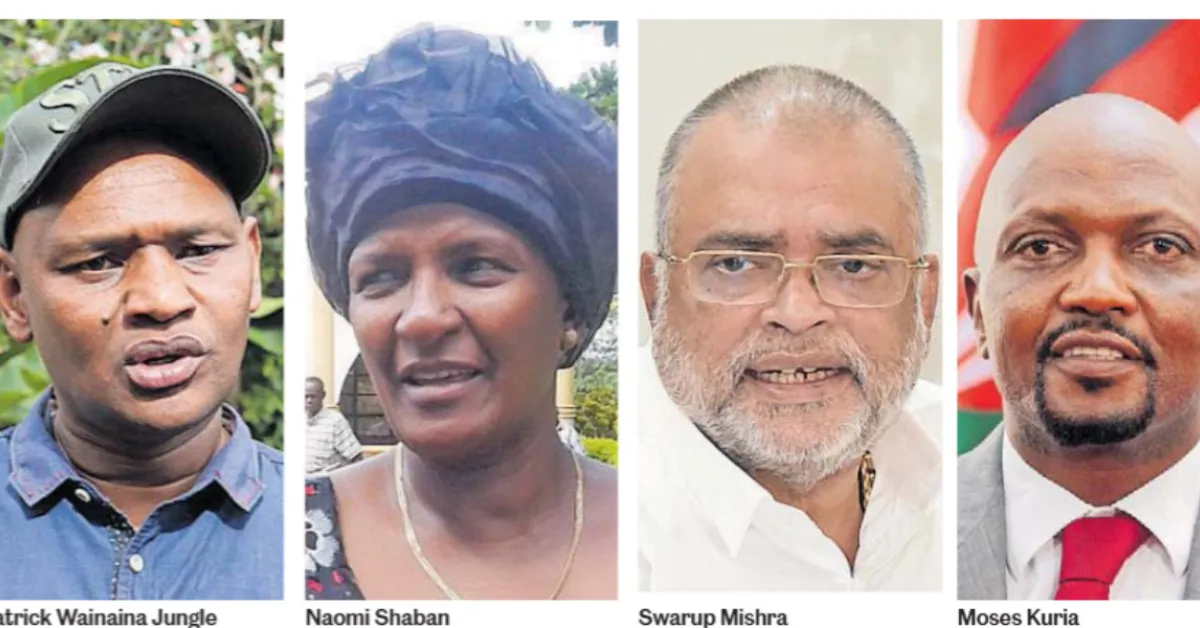

Even political figures, including President William Ruto’s Senior Economic Adviser, Moses Kuria and former Members of Parliament Naomi Shaban (Taveta), Charles Kilonzo (Yatta), and Swarup Mishra (Kesses), find themselves in similar predicaments as auctioneers target their properties. The agribusiness sector has been particularly affected, with leading macadamia nut processors like Equatorial Nuts Ltd, owned by Peter Munga, and Jungle Macs EPZ, led by former Thika Town MP Patrick Jungle Wainaina, struggling to avert debt-related asset seizures.

These firms specialise in processing macadamia nuts, peanuts, and cashews for export, contributing significantly to Kenya’s agricultural exports. The financial struggles of these business leaders and political figures highlight the broader economic challenges facing Kenya, including the impact of the post-pandemic recovery, persistent inflationary pressures, and aggressive lending practices by financial institutions.

Peter Munga recently faced a significant setback when he failed to prevent the sale of his 75 million shares in Britam Kenya. African Banking Corporation (ABC) is attempting to recover KSh433.7 million from Equatorial Nut Processors, with the shares valued at KSh510 million. This is not the first time Munga has encountered auction threats. In 2017, he narrowly avoided losing five prime properties in Kasarani, Nairobi, valued at KSh400 million, after reaching a last-minute settlement with Jamii Bora Bank, now trading as Kingdom Bank.

However, similar financial pressures resurfaced in 2023 when auctioneers targeted three properties linked to him over outstanding loans. For Patrick Jungle Wainaina, the financial strain has resulted in the loss of critical infrastructure. The High Court recently declined his request to block the sale of one of his cashew processing machines, which was auctioned for KSh70 million by Guaranty Trust Bank due to an unpaid debt of over KSh1 billion. His company, Jungle Cashews (EPZ) Ltd, had borrowed substantial sums, including $4,311,795 (KSh557 million) and KSh447 million, but defaulted on repayment, leading to the asset seizure.

The financial turmoil extends beyond the agribusiness sector into logistics and construction. Buzeki Enterprises Ltd, owned by businessman Zedekiah Bundotich, faced a significant financial burden after failing to settle debts amounting to KSh2.7 billion with NCBA Bank. The company had initially borrowed the money to finance the acquisition of a fleet of 289 trucks and 141 trailers, but financial strain led to multiple lawsuits. Buzeki Enterprises was also embroiled in disputes over a KSh35.8 million debt with Express Shipping and Logistics EA in 2021, as well as a KSh118 million land transaction with Landmark Port Conveyors Ltd, further exacerbating the firm’s financial woes.

In the construction sector, Nyoro Construction Company, owned by Josiah Njoroge Njuguna, is facing auctioneers over KSh860 million owed to KCB Bank. The firm lost its bid to block the bank from auctioning its assets after arguing that the default was caused by delayed government payments for completed projects. Justice Peter Mulwa recently ruled that Nyoro Construction must honour its financial obligations, stating that the company could not seek court protection without settling the outstanding debt. The auction targets include parcels of land, residential houses in South B, Nairobi, commercial property along Mombasa Road, and industrial godowns.

Nyoro Construction has been a significant player in Kenya’s infrastructure development, undertaking projects worth billions of shillings under different administrations. The firm was responsible for constructing key roads during President Mwai Kibaki’s tenure, including the Processional Road in Nairobi and multiple roadworks in Nakuru and Murang’a counties. Under President Uhuru Kenyatta, the company secured contracts for road rehabilitation in Gikomba and Murang’a, among other projects.

The financial woes have not spared government officials, highlighting the pervasive nature of the economic pressures. Moses Kuria, formerly Kenya’s Trade and Investment Cabinet Secretary and now President Ruto’s Senior Economic Adviser, has been locked in a battle with Equity Bank over unpaid debts totalling KSh54 million. The debt, initially KSh50 million, was borrowed in 2018 and was secured by two properties in Kiambu County. Court documents show that Kuria had agreed in January 2025 to repay KSh850,000 per month but failed to meet the commitment.

In March, he made a partial payment of KSh733,000, falling short of the agreed amount. Kuria attributed his financial struggles to challenges in developing the properties due to the Covid-19 pandemic, which led to skyrocketing costs of construction materials. He also cited personal health issues, including a period of hospitalisation following an accident, as reasons for failing to settle the debt. Despite his plea, Justice Aleem Visram dismissed Kuria’s request to halt the auction process, emphasising that financial obligations must be honoured regardless of personal difficulties.

The court ruled that the bank had acted lawfully and that the debt remained unpaid for an extended period. As the Kenyan economy navigates post-pandemic recovery and persistent inflationary pressures, businesses and individuals alike are struggling to stabilise their finances.

Add new comment