No More Cheap Loans for Kenyans as Gov't Moves to Repeal Interest Rate Cap Law

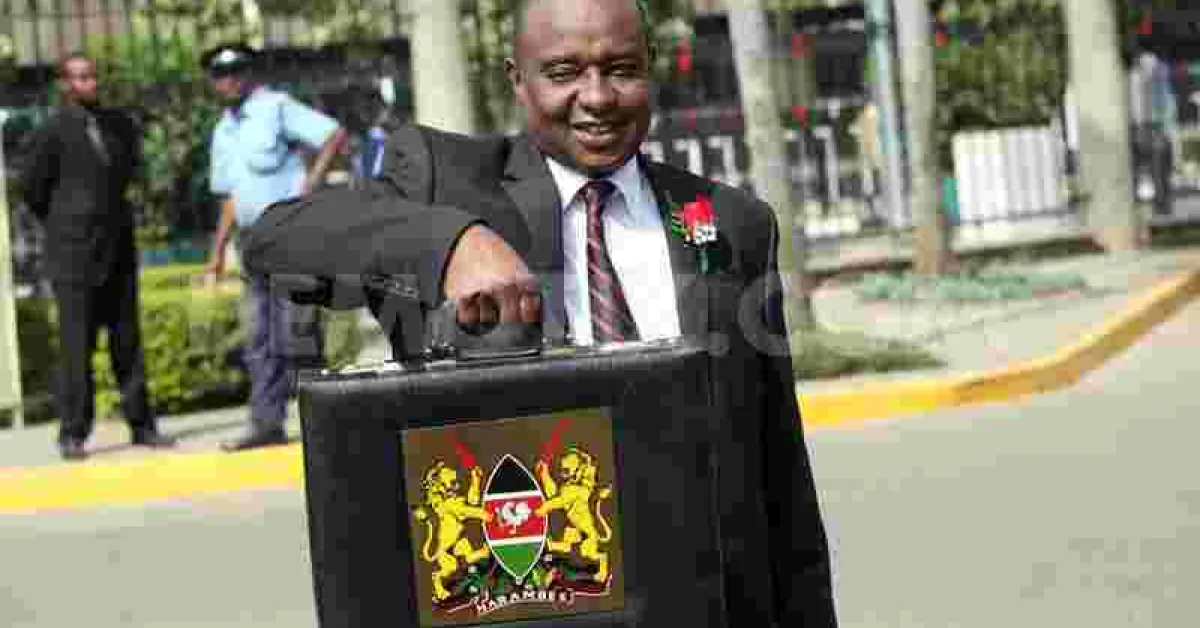

Treasury Cabinet Secretary Henry Rotich has announced the state will revise the interest rates capping law that took effect in September 2016, a move that will put to an end access of cheap loans by Kenyans.

In what could see local lenders return to high profits again, Rotich said the move is meant to support economic growth by reviving lending to the private sector.

The enactment of the rate caps resulted to a major slowdown in lending to the private sector as banks increased their investment in government bonds and T-bills.

“In order to enhance access to credit and minimise the adverse impact of interest rate capping on credit growth while strengthening financial access and monetary policy effectiveness, I propose to amend the Banking (Amendment) Act, 2016 by repealing Section 33B of the said Act,” Mr Rotich said in his budget statement to Parliament on Thursday.

However, Consumers Federation of Kenya (Cofek) has criticised the move and has asked MPs to reject the proposed amendment, arguing that it will disadvantage ordinary Kenyans wishing to take loans.

“It is wrong that Mr Rotich has bowed to pressure from the International Monetary Fund (IMF) and local banks at the expense of consumers,” the advocacy group said in a statement.

“We urge MPs to veto the proposal with the contempt it deserves. The matter is actively in court,” Cofek said.

CS Rotich said the proposed changes would create a fair, transparent, competitive, efficient and accessible credit market to serve the needs of borrowers.

The 2016 law set the maximum lending rate at no more than 4 per cent above the Central Bank of Kenya's base rate, which currently stands at 9.5 percent.

A study by CBK shows that the law had failed to achieve its intended aim of increasing credit access to small and medium enterprises by limiting the cost of borrowing for individuals and businesses.

Add new comment