Winners and Losers of Kenya’s Sh3.07 Trillion 2018/2019 Budget

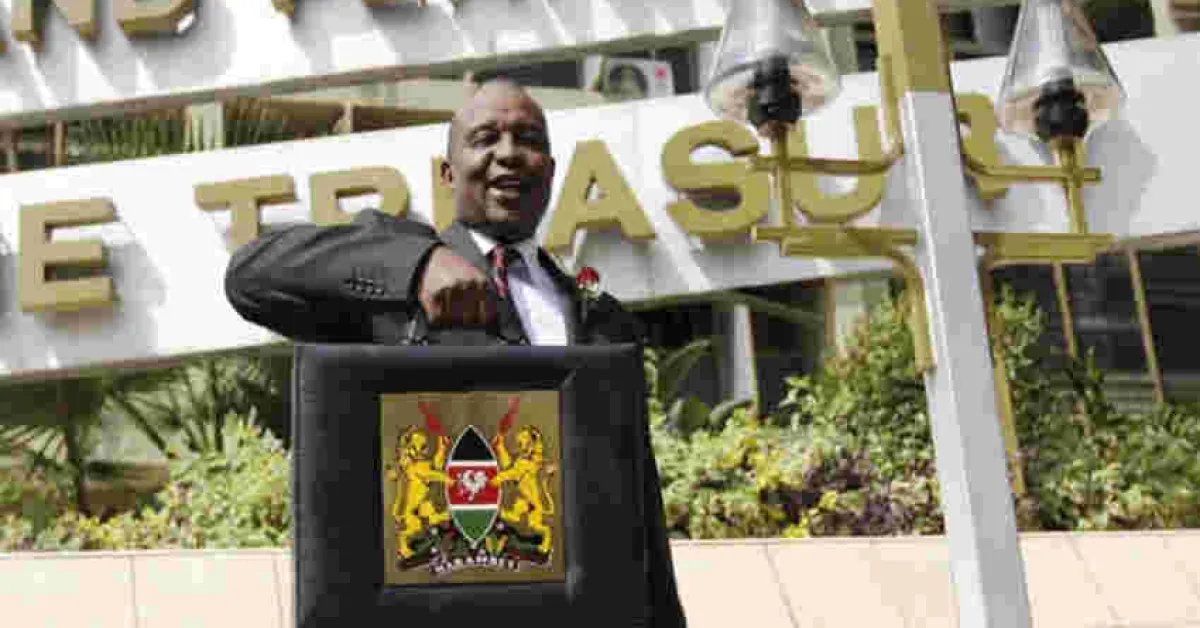

There were winners and losers in the Sh3.07 trillion 2018/2019 financial year budget unveiled by Treasury Cabinet Secretary Henry Rotich on Thursday.

Local manufacturers of steel, textile and timber are among the biggest winners of the record budget. In the spirit of promoting local manufacturers under the mantra, "Buy Kenya Build Kenya", Rotich said government had introduced what may be described as punitive tax measures on cheaper imports of products that are locally available.

Local manufacturers of steel will benefit from the increase of import duty from current 25 percent to 35 percent on iron and steel products produced in the region.

Rotich also slapped an import duty of 5 US dollars per unit or 35 percent of the value of textile and footwear in a bid to boost market for local textile and footwear manufacturers.

The CS also imposed increased taxes on imported vegetable oil to promote locally produced products. For every Metric tonne of vegetable oil imported, Sh50, 000 will be payable to the Kenya Revenue Authority (KRA) or 35 percent of the value.

Other winners of the budget are local makers of pesticides and acaricides, tour operators and energy cooking stoves, who have had their taxes either reduced or imports from the region taxed higher.

Assemblers of computers have been exempted from paying tax for parts imported or purchased locally to encourage local manufacture, innovation and creation of employment opportunities.

Cancer patients also gained as Sh7 billion for securing of cancer screening machines was allocated, and further Sh400 million for a cancer institute to enable early diagnosis and thus boost chances of treatment.

On the other side, mobile Money transfer services including; Mpesa, T-Kash, Airtel Money and Equitel customers are some of big losers as they will now be charged 12 percent up from 10 percent of every transaction they make.

Those transacting large volume of money between banks and other financial institutions will now incur a 0.05 percent of excise tax for every Sh500,000 you transferred.

Those importing cars above 2500 cc for diesel cars and 3000 cc for petrol run automobiles, will pay an excise duty of 30 percent, up from 20 percent.

Dividend earnings now attracts a withholding tax charge of 5 percent, and replaces compensating tax that was being charged previously.

Finally, those exporting scrap metal outside the country will now pay 20 percent as export levy.

Comments

Don't see the wisdom of…

Permalink

Don't see the wisdom of charging poor mwananchi more to transfer money on Mpesa.12% is too much, in essence, it is outright thuggery. The Mpigs, MCAs, governors salaries should have been taxed instead.

Add new comment