MPs Vow to Shoot Down Govt's Plan to End Cheap Loans for Kenyans

A section of Members of Parliament have vowed to shoot down plans by the National Treasury to repeal the interest rate cap law that gave Kenyans access to cheap loans from banks.

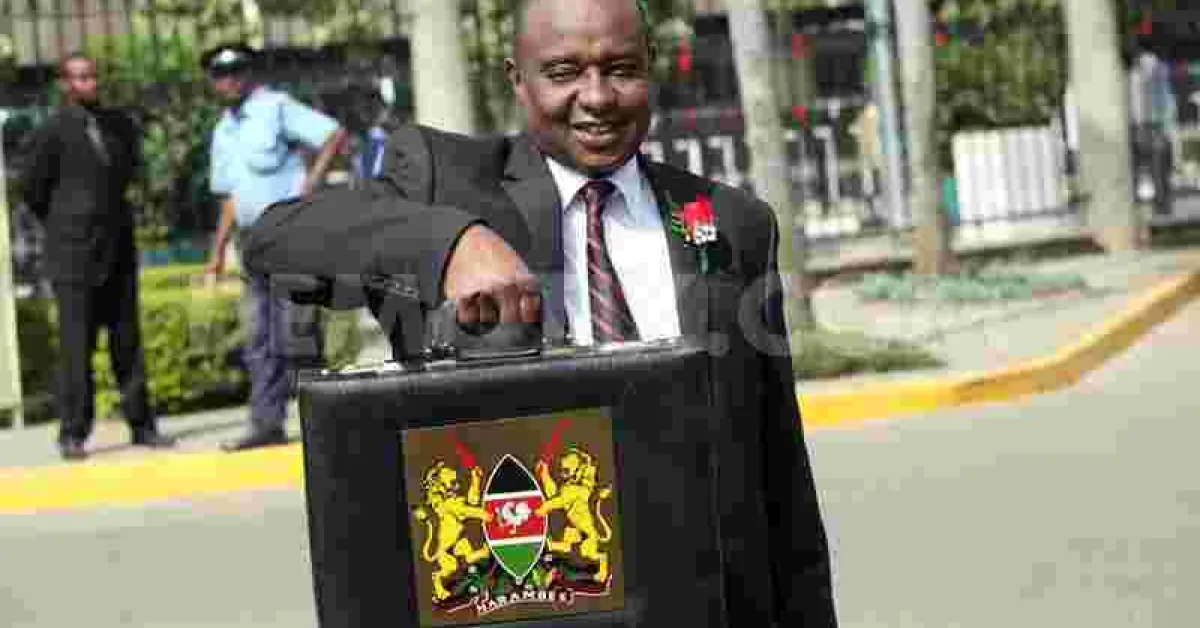

While reading 2018/2019 budget statement at the National Assembly on Thursday, Treasury Cabinet Secretary Henry Rotich said the law, which took effect in 2016, will be repealed. He said repealing the law will support economic growth by reviving lending to the private sector.

The enactment of the rate caps resulted to a major slowdown in lending to the private sector as banks increased their investment in government bonds and T-bills.

“In order to enhance access to credit and minimise the adverse impact of interest rate capping on credit growth while strengthening financial access and monetary policy effectiveness, I propose to amend the Banking (Amendment) Act, 2016 by repealing Section 33B of the said Act,” Mr Rotich said in his budget statement to Parliament on Thursday.

However some MPs have reacted furiously to Rotich’s proposal. National Assembly Minority leader John Mbadi accused Rotich of succumbing to “blackmail” by lenders who cause suffering to the public.

Mbadi said he will rally Opposition MPs and those from the ruling side to protect the interests of Kenyans who need access to cheap credit.

"The rates have stabilised and amending it will make the banks run amok and destabilise the market as was the case before,” Mbadi, an accountant, said.

Kiambu MP Jude Njomo, who crafted the interest rate cap law, said the National Treasury and the Central Bank of Kenya were trying to please a ‘cartel’ of banks denying Kenyans credit to push for the repeal.

“It is wrong for Treasury to do what the banks want and think that the financial institutions will now behave and make credit available,” he said.

“We’ll not support the repeal. It’s meant to enrich a few people,” he warned, accusing the CBK of working with banks to frustrate credit access.

“We know banks are not lending to SMEs because that’s what they promised to do when we were enacting the law. They are now working as cartels on that promise as they did with high interest rates.”

The Consumers Federation of Kenya (Cofek) also dismissed Rotich’s proposal and urged MPs to veto the move.

“We urge MPs to veto the proposal with the contempt it deserves. The matter is actively in court,” it said in a statement. Cofek said Rotich’s promise to protect small and medium-sized firms through a credit guarantee scheme rings hollow.

“It’s wrong that Rotich has bowed to pressure from the International Monetary Fund and local banks at the expense of consumers,” the advocacy group said.

Rotich's proposal comes after a team from the International Monetary Fund (IMF) in February asked the government to reconsider the interest rate cap as a way of releasing funds to SMEs and the private sector, a call that was backed by local lenders.

The 2016 law set the maximum lending rate at no more than 4 per cent above the Central Bank of Kenya's base rate, which currently stands at 9.5 percent.

Comments

You should 1st Shoot Down…

Permalink

You should 1st Shoot Down your Hefty Salaries and Allowances for Doing Nothing (including SOME of you having Motioned NOT a Single Issue in Parliament).

By falling prey to the arm…

Permalink

By falling prey to the arm twisting by banks and the IMF the Treasury & finance ministry are orchestrating a betrayal of Kenyans of the highest order. For decades, banking cartels have ensured that Kenyans remain slaves to high interest rates as they enrich themselves. Any MP worth his / her salt should be more than ready to shoot down this proposal

These MPgs better 1st "Shoot…

Permalink

These MPgs better 1st "Shoot Down" their Unnecessary HEFTY Salaries and Allowances (some of them having Initiated no Motion in Parliament EVER).

Add new comment