Kenya and Singapore Ink Landmark Double Taxation Agreement

Kenya has made a notable stride in its international economic relations by finalizing a Double Taxation Agreement (DTA) with Singapore.

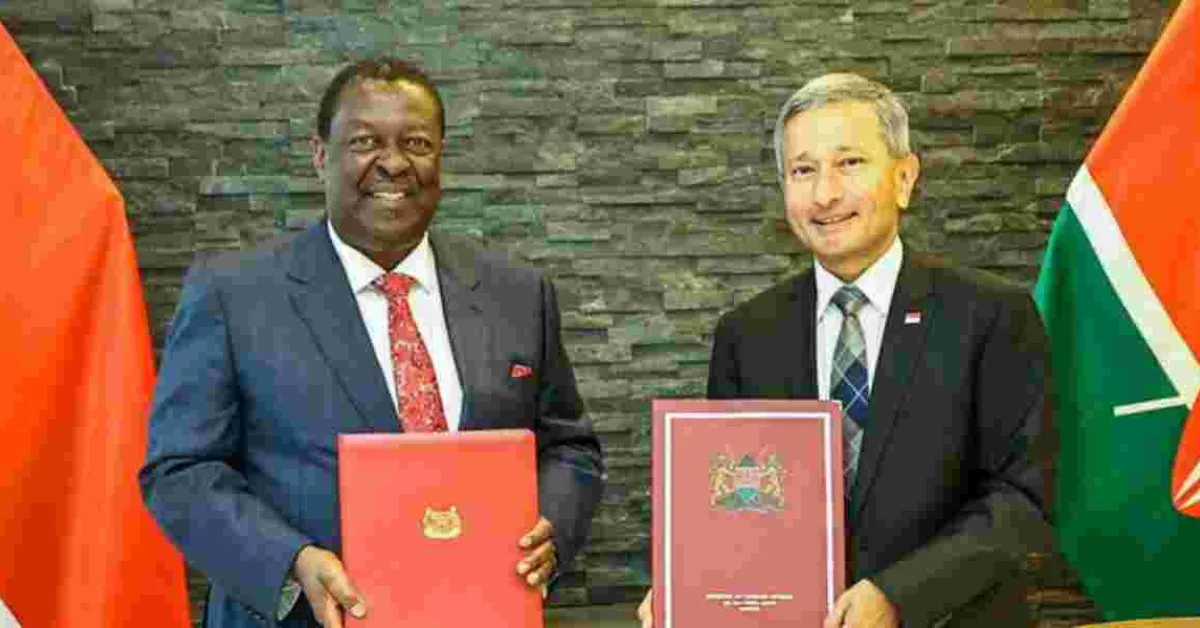

This accord, reached during the United Nations General Assembly, marks Singapore as the 50th nation to establish such an arrangement with Kenya. The agreement aims to eliminate the burden of double taxation, thereby facilitating cross-border trade and investment between the two countries. The DTA, signed by Kenya's Foreign Affairs Cabinet Secretary Musalia Mudavadi and Singapore's Vivian Balakrishnan, supersedes a previous agreement from 2018. It is expected to have far-reaching implications, particularly for businesses operating in sectors such as shipping, logistics, and financial technology, where Singapore already maintains a significant presence in Kenya.

This agreement extends beyond mere tax considerations, promising to streamline cross-border business operations. Kenyan enterprises in Singapore and Singaporean businesses in Kenya will benefit from more transparent taxation rules. The impact will be particularly noticeable in industries such as agribusiness and port management, where importers, exporters, and investors are likely to experience immediate relief. The DTA outlines provisions for businesses with permanent establishments in either country, allowing deductions for operational expenses including administrative and executive costs.

This ensures that profits generated across borders are not subject to double taxation. However, certain industries, notably banking, have been granted exceptions to prevent the exploitation of royalties or interest payments. Under the new framework, profits from activities such as international shipping or aircraft rentals will only be taxed in the country where the business is headquartered, providing significant advantages to shipping and airline industries with operations in both nations. The agreement also holds potential benefits for individual taxpayers engaged in cross-border professional activities. By providing clear tax guidelines, it aims to reduce confusion and minimize disputes regarding the appropriate jurisdiction for income tax payments.

This DTA is seen as a strategic move for Kenya, often likened to Singapore in its aspirations to become an economic powerhouse. Beyond the DTA, Kenya and Singapore have signed additional agreements to enhance cooperation in various sectors. These include memorandums of understanding on climate change, skills development, and the digital economy. The climate change agreement, in particular, will facilitate collaboration on carbon credits and greenhouse gas reduction under the Paris climate agreement, addressing the shared challenges of climate change faced by both countries.

The signing of these agreements took place on the sidelines of the UNGA. Prime Cabinet Secretary Musalia Mudavadi emphasized that the DTA provides clarity on cross-border income taxation and establishes a robust framework to prevent double taxation of businesses and individuals engaged in transnational activities. This agreement is expected to significantly reduce barriers to cross-border investments and foster greater trade and economic cooperation between Kenya and Singapore.

Comments

I do not mind a company from…

Permalink

I do not mind a company from Singapore doing a PPP over JKIA, not an Indian company with tens of corruption cases

Add new comment