Why Kenya Government Will Switch Off Millions of Phones Next Week

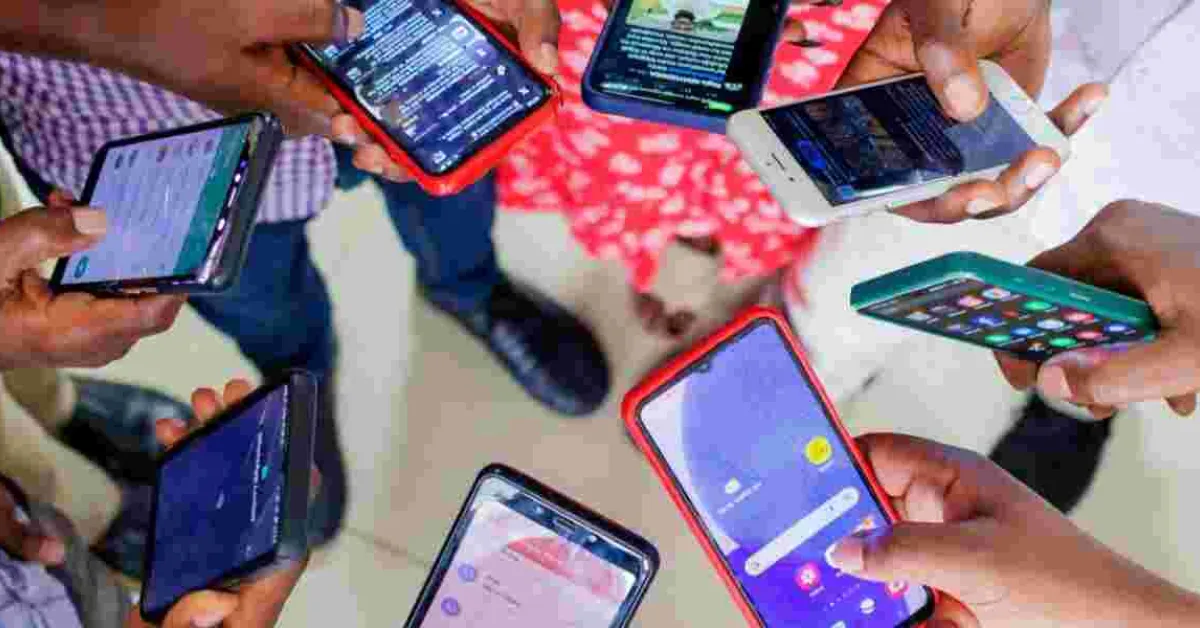

The Communications Authority of Kenya (CA) is implementing changes to mobile device taxation with a new directive set to take effect on November 1, 2024.

The initiative aims to strengthen tax compliance across Kenya's mobile phone sector through comprehensive tracking and verification measures. At the heart of the directive is a requirement for all mobile devices, whether imported or locally assembled, to have their International Mobile Equipment Identity (IMEI) numbers registered with the Kenya Revenue Authority (KRA). Local assemblers must upload these unique identifiers to a dedicated KRA portal, while importers must include IMEI numbers in their import documentation, regardless of whether devices are intended for sale, testing, or research purposes.

The regulatory framework extends throughout the supply chain, with retailers and wholesalers permitted to sell only tax-compliant devices. Mobile network operators bear responsibility for ensuring that exclusively compliant devices connect to their networks. To manage the transition, the CA has established a grey-listing system, offering a grace period for importers and assemblers to bring their devices into compliance before facing potential blacklisting and network disconnection. These new requirements are expected to create ripple effects throughout Kenya's mobile phone market.

In the immediate term, local assemblers and importers may face increased operational costs as they adapt to the enhanced documentation and compliance procedures. These additional expenses could potentially translate to higher retail prices thus raising concerns about device affordability for Kenyan consumers. However, the long-term implications may prove more positive. The directive could incentivize mobile manufacturers to establish local assembly operations within Kenya to mitigate double taxation effects. Such a shift could stimulate domestic manufacturing investment and generate employment opportunities.

Furthermore, the enhanced regulatory framework may foster a more stable market environment by reducing the impact of non-compliant imports on price volatility. The initiative represents part of Kenya's broader strategy to modernize its tax collection infrastructure and ensure equitable contribution across economic sectors. The government aims to bolster revenue collection while reducing tax evasion By incorporating the mobile phone sector more thoroughly into the tax system. This approach aligns with international practices, as numerous countries have adopted similar measures to enhance tax compliance in their mobile device markets.

Comments

Do these government…

Permalink

Do these government officials give regards to all citizens when issuing some of these threats? They should give people time to comply first, then impose the deadline.

Ngoma!

I’m pretty sure that they…

Permalink

In reply to Do these government… by mteja (not verified)

I’m pretty sure that they just didn’t wake up and issued a decree, the regulation is coming up on November 1st! Procrastination shenanigans only hurts procrastinators and hard heads who ignores the laws!!!

I remember a time that I would visit and buy a mobile phone just like you would buy a bread on the streets! They were not registered or regulated at all which was insane and a heaven for all types of criminals!!

Just like your car/driving license etc are regulated, so does a phone!!! Snooping on your phone without a warrant on the other hand is and must be illegal!!!

Add new comment