KRA Freezes Payment of Tax Reliefs Pending an Audit

Kenya Revenue Authority (KRA) has suspended the payment of tax refunds pending an audit of the claims.

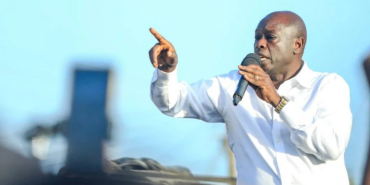

In a statement, KRA Chairman Anthony Mwaura said the decision to suspend the payments will enhance the current processes related to the payment of tax refunds, exemptions, waivers, and abandonments.

“In the past five years, KRA has granted tax reliefs and incentives totaling Sh610 billion, with an average of Sh122 Billion per annum. The move to suspend payment of tax reliefs allows KRA to audit and enhance the tax relief processes and procedures,” said Mwaura.

Mwaura said the tax authority will continue to comply with the law by assessing and processing the tax reliefs during the audit phase with no payment being disbursed until the process is concluded.

KRA further said the suspension of tax relief payments follows concerns from taxpayers, hence the need to restructure rules and procedures governing tax exemptions.

“The current suspension and ongoing review of tax reliefs is also aimed at increasing the impact of tax expenditure on economic growth. This will be achieved through minimizing tax expenditure and aligning it with international best practices for better internal revenue,” added Mwaura.

Mwaura expressed confidence that the enhancement of the tax relief process and procedures will offer a permissible issuance of tax exemptions and ensure equitable processing of tax reliefs. In addition, the audit is expected to help seal revenue leakage and enhance tax collection to support the government’s development agenda.

KRA added that the move is part of the aggressive revenue mobilization plan aimed at enhancing revenue collection and redirecting resources to finance priority growth-supporting programs.

"This move is aimed at powering the Bottom-up Economic Transformation Agenda (BETA). In addition to enhancing trust and facilitation, ICRA remains committed to the provision of excellent customer service to taxpayers. The Authority will continue working closely with taxpayers to resolve arising issues for ease of tax compliance," Mwaura noted.

Comments

If you are aggressive in…

Permalink

If you are aggressive in collecting the tax you should also be as aggressive in granting refunds to those who overpaid considering how many MPIGS and other bottoms ups newly appointed officials evade taxes some have been tried and convicted of the same and that did not stop them for being given plum jobs .The greed of this government is evident.Some of that money should be applied towards drought relief for how long will we rely on foreigners and their questionable NGO’s to feed the growing population we know you dare not push birth control considering you rely on the large population for votes every five years

Add new comment