Kenya's Construction Industry Battles Proposed 35% Excise Duty on Building Materials

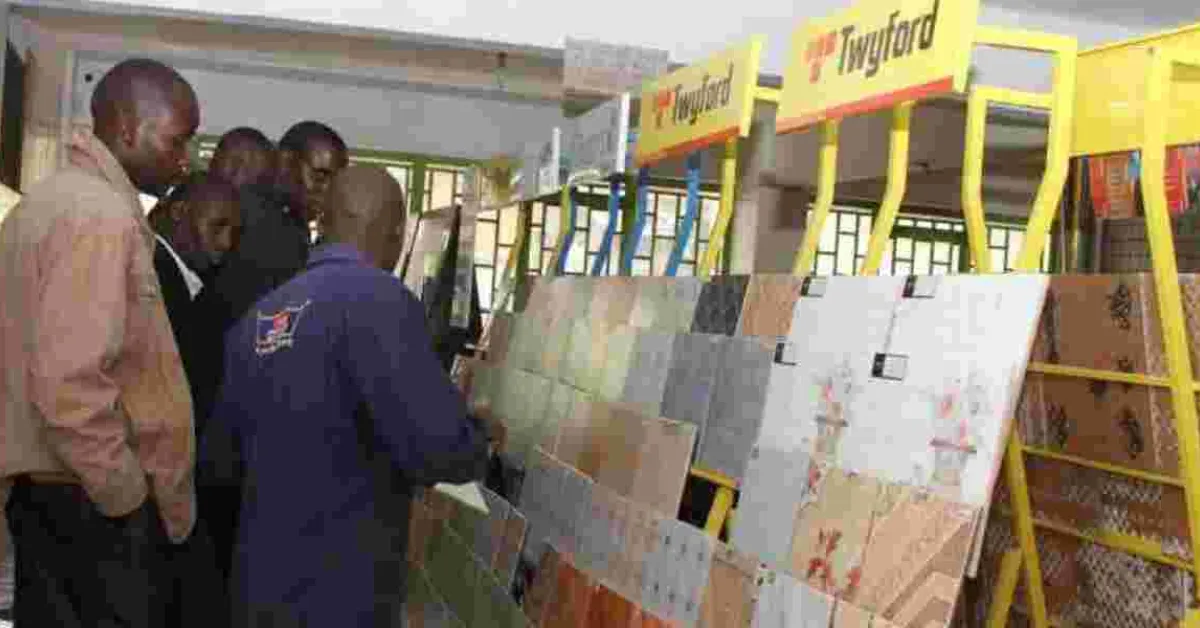

Concerns are mounting within Kenya's building and construction industry as stakeholders unite against a proposed 35 per cent excise duty on essential materials such as tiles, sinks, and toilets.

This initiative, part of the Tax Laws (Amendment) Bill 2024, has ignited debate with industry representatives warning that such a move could severely harm a sector that has been crucial in promoting the country’s economic growth. The proposed tax measures have initiated a coalition of construction firms to voice strong opposition during public consultations with the Parliament’s Finance Committee. These companies argue that while increasing local production is a noble goal, the existing manufacturing capacity in Kenya is far from adequate to satisfy the high demand for these essential goods.

They contend that imposing heavier taxes on imported sanitary ware and tiles could expedite the closure of many businesses. Under the new legislation, an excise duty of 35 per cent based on customs value, or Sh100 per kilogram, is proposed for imported sanitary ware, encompassing items like ceramic sinks, washbasins, baths, and urinals. A similar tax structure of 35 per cent or Sh300 per kilogram is suggested for imported ceramic tiles and unglazed mosaic cubes. Industry representatives emphasize that such significant tax hikes pose a threat to the survival of the building and construction sector in Kenya.

During their submissions to the National Assembly’s Committee on Finance and Planning, industry leaders indicated that the increased costs would likely render these products unaffordable for many consumers, resulting in a sharp decline in sales. This downturn could, in turn, lead to substantial job losses and a decrease in tax revenue for the government. Currently, the bill is undergoing a phase of public participation, a move seen as an attempt to reconcile with public sentiment following the rejection of the Finance Bill 2024.

Despite acknowledging the need to protect local manufacturing, stakeholders caution that local producers are not yet positioned to meet the nation’s demands for tiles and sanitary ware. They argue that lobbying efforts by a limited number of local manufacturers for heightened import taxes would disproportionately benefit a select few while undermining the broader industry. Furthermore, representatives highlight the considerable investments made by tile sellers in showrooms, warehouses, and logistics, investments that could be jeopardized if these amendments are enacted.

Add new comment